Page 1

Page 2

Page 3

Page 4

Page 5

Page 6

Page 7

Page 8

Page 9

Page 10

Page 11

Page 12

Page 13

Page 14

Page 15

Page 16

Page 17

Page 18

Page 19

Page 20

Page 21

Page 22

Page 23

Page 24

Page 25

Page 26

Page 27

Page 28

Page 29

Page 30

Page 31

Page 32

Page 33

Page 34

Page 35

Search

results in pages

Metadata

Taxes George B. Dorr

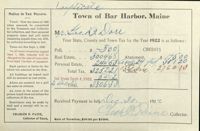

Notice to Tax Payers.

Duplicate

Date

192

Town of Bar Harbor, Maiae thuste

Voted: That the taxes of 1922

when assessed, be committed

Name

to the Treasurer and Collector

by Any G.V Rodicly+GA

for collection, and that personal

Messa Eruesto

property taxes and poll taxes

remaining unpaid June 1st, 1923,

be collected according to law.

Your State, County and Town Tax for the Year 1922 is as, follows :

Taxes are due Sept. 1, 1922.

Tax

$

On all taxes remaining unpaid

Poll,

$

CREDITS

Sept. 1, 1922, interest will be

Real Estate,

6552

charged at the rate of 6 per cent.

Abatement,

$

Interest

$

from Sept. 1 to date of payment.

Personal Estate,

Cash,

Each partner is liable for the

whole tax assessed to the firm.

Total

$

Total Tax, $ 6552

Check,

All buildings on leased land

will be assessed as real estate.

Int. from Sept. 1, 1922,

31

Abatement

Aliens are assessed for a poll

tax same as citizens.

Dec. 31 Total, $ 6683

An error in the name of the

Cash

person taxed does not defeat the

collection of the tax.

Remittance may be made by

Received Payment in full

192

Check

mail and a receipt will be re-

turned.

Year 1922.

CHARLES F. PAINE,

Collector.

Collector of Taxes,

Rate of Taxation, $39.00 per $1000.

APPROPRIATION AND ASSESSMENT

1921

1922

General Government

$ 9,500.00

$10,000.00

Protection of Persons and Property

16,650.00

15,650.00

Inspection of Weights and Measures

150.00

150.00

Health and Sanitation

2,200.00

2,250.00

Garbage Removal

3,500.00

3,500.00

Sewers

2,500.00

2,100.00

Charities and Corrections

6,500.00

7,200.00

Education

59,250.00

59,350.00

Library

500.00

500.00

Recreation

1,6,300.00

3,950.00

Water Rent

4,100.00

4,675.00

Interest

6,000.00

6,500.00

Notes and bonds

17,000.00

19,000.00

Highways

67,232.00

69,182.00

Mount Desert Bridge

4,482.72

4,827.54

Advertising Bar Harbor

6,200.00

6,200.00

Unclassified

1.050,00

450.00

State Tax

37,941.13

41,389.37

County Tax

9,915.84

9,915.84

Overlay

2,097.70

247.50

Total Assessment

$263,069.39

$267,037.25

PERCENTAGE OF APPROPRIATION

1921

1922

General Government

03611 per ct.

.03745 per ct.

Protection of Persons and Property

06333 per ct.

.0586 per ct.

Health and Sanitation

00087 per ct.

.00843 per ct.

Garbage Removal

0133 per ct.

.0131 per ct.

Sewers

0095 per ct.

.00786 per ct.

Charities and Corrections

02477 per ct.

.02696 per ct.

Education

22522 per ct.

.21476 per ct.

Water Rent

01558 per ct.

.0175 per ct.

Recreation

02394 per ct.

.0148 per ct.

Interest

.0228 per ct.

.02434 per ct.

Notes and bonds

06462 per ct.

.07115 per ct.

Highways

25556 per ct.

259 per ct.

Bridge

01704 per ct.

.01807 per ct.

Advertising Bar Harbor

02356 per ct.

.0₽322 per ct.

State Tax

14422 per ct.

.15499 per ct.

County Tax

03769 per ct.

.03713 per ct.

All other assessments

02189 per ct.

.01264 per ct.

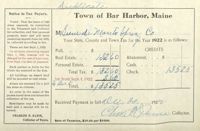

applicate

Notice to Tax Payers.

Town of Bar Harbor, Maine

Voted: That the taxes of 1922

when assessed, be committed

to the Treasurer and Collector

for collection, and that personal

Mr. Yes 12. Dore

property taxes and poll taxes

remaining unpaid June 1st, 1923,

be collected according to law.

Your State, County and Town Tax for the Year 1922 is as follows:

Taxes are due Sept. 1, 1922.

Poll,

$ 300.

CREDITS

On all taxes remaining unpaid

Sept. 1, 1922, interest will be

charged at the rate of 6 per cent.

Real Estate,

300468

Abatement,

$19500

from Sept. 1 to date of payment.

Personal Estate,

24453

ang Cash, 24, fid. 35120

Each partner is liable for the

whole tax assessed to the firm.

Total Tax, 325221

Balance 276013

All buildings on leased land

will be assessed as real estate.

Int. from Sept. 1, 1922,

5412

Aliens are assessed for a poll

tax same as citizens.

to Deb Total, 71 3306 3.3

An error in the name of the

person taxed does not defeat the

collection of the tax.

Received Payment in full

viles 30

Remittance may be made by

1924

mail and a receipt will be re-

turned.

CHARLES F. PAINE,

Collector.

Collector of Taxes,

Rate of Taxation, $39.00 per $1000.

APPROPRIATION AND ASSESSMENT

1921

1922

General Government

$ 9,500.00

$10,000.00

Protection of Persons and Property

16,650.00

15,650.00

Inspection of Weights and Measures

150.00

150.00

Health and Sanitation

2,200.00

2,250.00

Garbage Removal

3,500.00

3,500.00

Sewers

2,500.00

2,100.00

Charities and Corrections

6,500.00

7,200.00

Education

59,250.00

59,350.00

Library

500.00

500.00

Recreation

6,300.00

3,950.00

Water Rent

4,100.00

4,675.00

Interest

6,000.00

6,500.00

Notes and bonds

17,000.00

19,000.00

Highways

67,232.00

69,182.00

Mount Desert Bridge

4,482.72

4,827.54

Advertising Bar Harbor

6,200.00

6,200.00

Unclassified

1.050.00

450.00

State Tax

37,941.13

41,389.37

County Tax

9,915.84

9,915.84

Overlay

2,097.70

247.50

Total Assessment

$263,069.39

$267,037.25

PERCENTAGE OF APPROPRIATION

1921

1922

General Government

03611 per ct.

.03745 per ct.

Protection of Persons and Property

06333 per ct.

.0586 per ct.

Health and Sanitation

00087 per ct.

.00843 per ct.

Garbage Removal

0133 per ct.

.0131 per ct.

Sewers

0095 per ct.

.00786 per ct.

Charities and Corrections

02477 per ct.

02696 per ct.

Education

22522 per ct.

.21476 per ct.

Water Rent

01558 per ct.

.0175 per ct.

Recreation

02394 per ct.

.0148 per ct.

Interest

0228 per ct.

.02434 per ct.

Notes and bonds

06462 per ct.

.07115 per ct.

Highways

25556 per ct.

259 per ct.

Bridge

01704 per ct.

.01807 per ct.

Advertising Bar Harbor

02356 per ct.

02322 per ct.

State Tax

14422 per ct.

.15499 per ct.

County Tax

03769 per ct.

.03713 per ct.

All other assessments

02189 per ct.

.01264 per ct.

sublicate

Notice to Tax Payers.

Town of Bar Harbor, Maine

Voted : That the taxes of 1922

when assessed, be committed

to the Treasurer and Collector

for collection, and that personal

property taxes and poll taxes

M Sieurde Manto Spring Co

remaining unpaid June 1st, 1923,

Your State, County and Town Tax for the Year 1922 is as follows :

be collected according to law.

Taxes are due Sept. 1, 1922.

On all taxes remaining unpaid

Poll,

$

CREDITS

Sept. 1, 1922, interest will be

charged at the rate of 6 per cent.

Real Estate,

132 60

Abatement,

$

from Sept. 1 to date of payment.

Personal Estate, .

Cash,

Each partner is liable for the

whole tax assessed to the firm.

Total Tax, $ 132 60

Check,

13525

All buildings on leased land

will be assessed as real estate.

Int. from Sept. 1, 1922,

2 60

Aliens are assessed for a poll

to Duc 31

tax same as citizens.

Total,

$ 13525

An error in the name of the

person taxed does not defeat the

collection of the tax.

Received Payment in

full Du 30

Remittance may be made by

192%

mail and a receipt will be l'e-

turned.

Collector.

CHARLES F. PAINE,

Collector of Taxes,

Rate of Taxation, $39.00 per $1000.

APPROPRIATION AND ASSESSMENT

1921

1922

General Government

$ 9,500.00

$10,000.00

Protection of Persons and Property

16,650.00

15,650.00

Inspection of Weights and Measures

150.00

150.00

Health and Sanitation

2,200.00

2,250.00

Garbage Removal

3,500.00

3,500.00

Sewers

2,500.00

2,100.00

Charities and Corrections

6,500.00

7,200.00

Education

59,250.00

59,350.00

Library

500.00

500.00

Recreation

6,300.00

3,950.00

Water Rent

4,100.00

4,675.00

Interest

6,000.00

6,500.00

Notes and bonds

17,000.00

19,000.00

Highways

67,232.00

69,182.00

Mount Desert Bridge

4,482.72

4,827.54

Advertising Bar Harbor

6,200.00

6,200.00

Unclassified

1.050,00

450.00

State Tax

37,941.13

41,389.37

County Tax

9,915.84

9,915.84

Overlay

2,097.70

247.50

Total Assessment

$263,069.39

$267,037.25

PERCENTAGE OF APPROPRIATION

1921

1922

General Government

03611 per ct.

.03745 per ct.

Protection of Persons and Property

06333 per ct.

.0586 per ct.

Health and Sanitation

00037 per ct.

.00843 per ct.

Garbage Removal

0133 per ct.

.0131 per ct.

Sewers

0095 per ct.

.00786 per ct.

Charities and Corrections

02477 per ct.

.02696 per ct.

Education

22522 per ct.

.21476 per ct.

Water Rent

01558 per ct.

.0175 per ct.

Recreation

02394 per ct.

.0148 per ct.

Interest

0228 per ct.

.02434 per ct.

Notes and bonds

06462 per ct.

.07115 per ct.

Highways

25556 per ct.

259 per ct.

Bridge

01704 per ct.

.01807 per ct.

Advertising Bar Harbor

02356 per ct.

.0₽322 per ct.

State Tax

14422 per ct.

.15499 per ct.

County Tax

03769 per ct.

03713 per ct.

All other assessments

02189 per ct.

.01264 per ct.

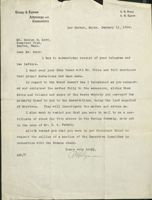

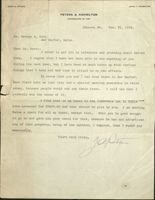

Deasy & Lynam

L. B. Brasu

Attorneys and

A. iii. Lynam

Counselors

Bar Harbor, Maine, January 11, 1918.

Mr. George B. Dorr,

Somerset Club,

Boston, Mass.

Dear Mr. Dorr:

I beg to acknowledge receipt of your telegram and

two letters.

I went over your Eden taxes with Mr. Paine and felt convinced

that proper deductions had been made.

In regard to the Mount Desert tax I telephoned as you request-

ed and explained the matter fully to the assessors, giving them

dates and volumes and pages of the deeds whereby you conveyed the

property taxed to you to the Reservations, being the land acquired

of Morrison. They will investigate the matter and advise me .

I also want to remind you that you were to mail to me a cer-

tificate of stock for five shares in the Spring Company, made out

in the name of Mr. E. G. Fabbri.

Also to remind you that you were to get President Eliot to

request the calling of a meeting of the Executive Committee in

connection with the Homans check.

Yours very truly,

AHL/C

Allogum

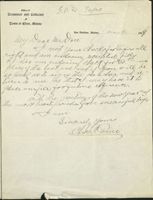

Office of

S.B.D Tapes

Treasurer and Collector

Town of Eden, Maine

Bar

my Dear mr. Dorr:

Harbor, Maine, Jane 4.

1918

right and am enclosing receipted fills 00

l reed your checksfortake all

Kl also am endoried check for 60.00 in be

place of the last ame and you will

-

here to me no that may have it

so Kind as to sign the and re to

place an file forfective reference.

the most hearty wishs fort a successful

with the geeeing of the new year hip wal

A am

Sincerely your

JOHN A. PETERS

JOHN F. KNOWLTON

PETERS & KNOWLTON

COUNSELORS AT LAW

Ellsworth, Me.,

Dec. 31, 1914.

Mr. George B. Dorr,

Bar Harbor, Maine.

Dear Mr. Dorr:-

I tried to get you by telephone and probably shall before

long.

I regret that I have not been able to see anything of you

during the last year, but I have been SO much taken up with various

things that I have not had time to attend to my own affairs.

It seems that you and I had some taxes in Bar Harbor.

Bert Clark told me that they had a special meeting yesterday to raise

money, because people would not pay their taxes. I told him that I

probably was the cause of it.

I find that in my taxes is the Intervale Lot at Hulls

Cove assessed for $3400.00 and that should be paid by you. I am sending

Paine a check for all my taxes, except that. Will you be good

enough

to go in and give him your check for that, because he has not advertised

any of this property, being of the opinion, I suppose, that I would pay

eventually.

Yours very truly,

Jane

COSMOS CLUB

WASHINGTON, D. C .

6

Wear Mr Lynawn,

I welon ym

Check for my our lafer,

2760 3/1 according to

you lette just Come I

luctor Separate Cheely for

the interest I &

due

-

4 months at6 of

$3520 - Please make

Cutam that this discharges

all,

field tal Concerny Which

Mn Wow told the be had

paid the Nursiries tal

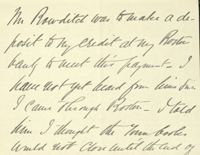

M Rowditd was to maler a de-

posit to ny credit althy Roster

band that this payment I

have out yet beard from his fine

I Came through Roster_ Mold

him I thought

would not Clou until the lud of

the Coming Week- Do I mould

like not have my Check deforited

by the Pain so that it will with

Roster before Wednesday, Which

it will not if ym pay it in on

Minda before woon the dou

COSMOS CLUB

WASHINGTON, D.C.

not

the bank

Roster by it hutel

Tuesda, -

I will unit late today

Concerning the Pnaver Grad

Ur won't hold uh the

transaction on throad

strif but get the

Wort farnable wonbuide

agreement green

that uu Can 1

Check lucloud

are 28-1922

wee. 29

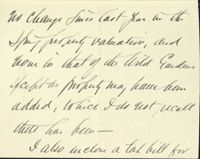

COSMOS CLUB

WASHINGTON, D.C.

1922

WEAR M Lynam,

I enclose Checker

for the

Unta Garden of Acadia

and the View de Monte

spring taken, plus 4 mmth

interest on cale, at 6% to

January 1th will you

please pay therefor Mu

and takes v

Rut please also yv our

the Change and make Juli

with reference th future

that all u wait should

be - There should be

no change Smee Cast you the

and

'

from W that of to bill Garden

yefta product may have been

added, Which I do not wcall

there has been

-

I also luclou a tal bill for

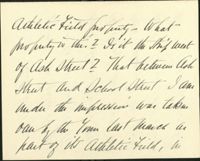

attletic Field probably What

property in this It it the Kit west

of ash street? that between ash

Hunt And School street I am

Midu the impression was take

Ym las March a

hait of its athletic field, the

COSMOS CLUB

WASHINGTON, D.C.

Whiet Can ithan has allerand

the taking th that pustin

Pleas find out about this

Vlet un kum by, utum

mail to the University

Club, (Fifth am V 54" st

new Youg Cig- Where I

shall be of the

week-

Guill stud you a check

for My our to take

Which I will askyym

similarly tool after,

Yamin autifor me

The National Part Appro

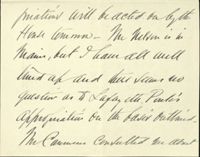

prictions will beacted on ly the

House Common- Mr Welvon is he

main, but I baur all will

kind af and these fectures no

question as Lafay eth Poule's

appropriation On the favir outbind

Consulted the about

hip x will do his but

for you project to letter

I am layay plan to get a

Steam Should for the road, as a

Code al Cort of fright and Jone

upain You huly and

but wish for the Ciny

Again

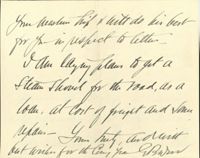

I am enclosing two tap bills

of

Ono. Dorris - -One Desert and

for dspoke to

Serenus about them our but

he was about to go away at that

time and said hid lake them

up with the Bank later I for got

about them until this second

notice from Onk Depret should same

on saturday. of they the

want Orr. world gay interest

due ou them There let me know

the amounts due t I'll send it ug.

Chyllin

George B. Dorr Tax Valuation at Southwest Harbo r.

1941

Fernald Lot

21 acres

$ 216.00

Lurvey Spring Lot 25 acres

500.00

Herrick Lot

7 acres

210.00

Higgins Lot

5 acres

50.00

Carpenter Lot

5 acres

60.00

Phillips Lot at Long Pond 1/2 acre

50.00

Mountain Lot - west of pump station

30 acres

300.00

$1380.00

GEORGE B. DORR

1942.

TOWN OF SOUTHWEST HARBOR, MAINE.

Valuation

Fernald Lot

21 acres

$210.00

Lurvey Spring Lot

25 acres

500.00

Herrick Lot

7 acres

210.00

Higgins Lot

5 acres

50.00

Carpenter Lot

5 acres

60.00

Phillips Lot at Long Pond 1/2 acre

50.00

Mountain Lot - west of pump station 30 acres

300.00

$1380.00

Total Valuation

$1380.00

Tax Rate - $44.00 per M.

Total Tax for 1942

$ 60.72

GEORGE B. DORR

1942

TOWN OF MOUNT DESERT

Valuation

Lot of land on Parkers Point, Somesville, from

Susan Rush Higgins, bounded on north by land of

Madeline Dixon, on east by the Somes Sound, on

south and west by land of Heirs of Richard

Trimble. Vol. 635, Page 634. 2 a. 1st class $400.00

Total valuation

$400.00

Tax Rate $42.50 per M.

Total Tax for 1942. $ 17.00

July C, 1942.

Mr. George B. Dorr

Bar Harbor, Maine.

Dear Mr. Dorr:

I am enclosing herowith copy of tax valuations

on property owned by you in the Towns of Mt. Desert

and Southwest Harbor.

Very truly yours,

George B. Dorr, Valuation

Acres 1917 1918

Northerly portion of lot formerly owned by John

Conners, bounded north by land of David B. Ogdon,

same

and the sea; northeast by land of L. I... Luquer, Ma-

tilda C. Markoe and others and the sea: west by land

of the lt. Desert Nurseries and the Schooner Head

Road

19.04

33320

Cottage thereon, "Old Farm"

12000

Stable thereon

1500

Farm house thereon

500

Burns Cottage thereon

200

Douglass Cottage thereon

225

Ice house thereon

100

Laundry thereon

125

Shed thereon

25

Southern portion of lot formerly owned by John

W. Conners including granite quarry

50

5000

Quarry buildings thereon

500

House on Newport Mountain Road

250

Stable thereon

70

Building on west side of Main Street on land of

the Rodick Realty Company occupied by the B. H. & U.

R. P. Company

1000

Balance of the Enoch Leland lot, bounded north by

land of self: east by Harden Farm Road and the Cath-

olic Cemetery lot: south by land of the Milbridge

land Company; west by land of the Hancock County

Reservation

8.67

867

Lot bounded north by land of the Town of Eden

and land of self; east by the Great Meadow Road;

south and west by the Harden Farm Road

12.99

1299

Lot bounded north by Kebo Brook and land of

James Walport; least by the Great Meadow Road:

south and west by the land of the Town of Eden

and land of self

6.99

699

oorge B. Dorr, Valuation

Acres

1917

1918

Lot bounded north and east by land of the Town

same

of Eden; south and west by the Harden Farm Road

.4

50

Lot bounded north, east and south by land of the

Town of Eden; west by the land of the Mt. Desert

Golf Association

2.55

255

Lot bounded north by land of George B. Dcrr and

land of C. C. Morrison; east and south by land of

the Town of Eden and land of the Mt. Desert Golf

Association; west by land of self

2.67

267

Lot bounded north by land of the Ledgelawn

Cemetery and land of Mears, Morrison and Deasy;

east by Great Meadow Road; south by land of C. H.

Coats and land of Haskell; west by Kebo Brook and

land of the Town of Eden

1.53

153

Lot bounded north and east by the Harden Farm

Road; south by land of William M. Roberts: west by

land of self

4.2/3

700

Lot bounded north by Cromwell Harbor Road; east

and south by Cromwell Harbor Brook; west by land of

Mears, Morrison and Deasy

3.29 / 1550

85

Lot near Roberts Meadow bounded north by the

Harden Farm Road; east by land of the Rodick Realty

Company; south by Roberts Meadow; west by land of

self

6.3

275

Lot on southern side of Harden Farm Road, bound-

ed north by land of the Heirs of C. C. Burrill and

Harden Farm Road; east and west by land of the Pan-

cock County Reservation and others; south by land

of the Heirs of C. C. Burrill and others, conveyed

by deed from John 3. Howe and recorded in the Han- -

cock County Registry of Deeds, Vol. 474, Page 70

25.5

2040

Lot bounded north by Cronwell Harbor Road; east

by land of C. C. Morrison; south by land of self;

west by land of II. R. Hatfield, conveyed by deed re-

George B. Dorr, Valuation

Acres

1917

1918

corded in the Hancock County Registry of Deeds,

same

Vol. 476, Page 72

4

1800

Lot bought of Fountain Rodick, bounded north by

land of C. H. Wood: east by land of the Heirs of

T. T. Roberts; south by land of W. M. Roberts;

west by land of self

28

1400

Lot on Ledgelawn Avenue Extension bounded nor th

by land of Alvah Abbott; east by land of self;

south by land of Ora G. Strout; west by Ledgelawn

Avenue

2.1

400

Lots No. 49, 50, 51 and 52 on Strawberry Hill

on plan of land of H. D. Joy

1.05

400

Two-thirds lot known as the Beverly lot, being

western part of lot No. 58 on Peters Plan

83

1000

Lot bounded north by land of self and land of

W. M. Roberts: east by land of said Roberts:

south by land of the Hancock County Reservation;

west by the Great Meadow Road

25

2500

One-half lot No. 3, Section B, on plan of Shan-

non Estate, undivided and owned in common with

Augustus Thorndike

sq. ft.

1591

100

Lot on the west side of the Otter Creek Road

being six tenths undivided, bounded north by

land of the Rodick Pealty Company; east by the

Meadow Brook; south by land of self ; west by

the eastern line of the Notch Lot, so called

10

75

Lot at Otter Creek being lot conveyed by deed

to Clifton E. Dolliver and recorded in the Han-

cock County Registry of Deeds, Vol. 416, Page 454

16

160

Lots No. 20 and 21 on Joy Street on plan of

land of H. D. Joy, 1908

.45

150

Lots at Otter Creek conveyed by deed from

Joseph E. Tripp and recorded in the Hancock

County Registry of Deeds, Vol. 520, Page 304

5.3

110

-eorse B. Dorr, valuation

Acres

1917

1918

Le

Lot bounded north and east by land of the Kebo

same

Valley Club: south by land of self; west by land

of the Heirs of S. S. Lynde

4.5

450

Building on west side of Main Street occupied

by the Information Bureau

250

Total Value of Real Estate

71765

Lot bounded north by Cromwell Harbor Road ; east

by land of self: south by land of the It. Desert

Gold Association: west by Harden Farm Road

$500

$72265

Total

50

1 Horse

1

Cow ( 2 COWS 1918)

30

$60

Money at Interest in excess of debts

5000

1915 Ford Touring Car (1917 car)

125

165

Household Furniture in excess of $200.

850

Total Valuation of Personal Estate

6055

6125

Total Valuation of Personal and Real Estate

77820

78390

George B. Dorr, Valuation

Acres

1917

1918

Lot bounded north and east by land of the Kebo

same

Valley Club; south by land of self; west by land

of the Heirs of S. S. Lynde

4.5

450

Building on west side of Main Street occupied

by the Information Bureau

250

Total Value of Real Estate

71765

Lot bounded north by Cromwell Harbor Road : east

by land of self; south by land of the Mt. Desert

Gold Association; west by Harden Farm Road

1/2

$500

Total

$72265

1 Horse

50

1 Cow ( 2 COWS 1918)

30

$60

Money at Interest in excess of debts

5000

1915 Ford Touring Car (1917 car)

125

165

Household Furniture in excess of $200.

850

Total Valuation of Personal Estate

6055

6125

Total Valuation of Personal and Real Estate

77820

78390

3,500.

On

the

frame

Dwelling House and additions, including foundations, towers, extensions. porches

and piazzas, plain. plate and ornamenta] glass, fresco, gilding, decorations and other ornamental and decorative works,

cabinet work, stationary mirrors, furnaces, plumbing, ventilating. heating, pumping. elevating and lighting and electrical

apparatus and fixtures, yard fixtures and fences, lawnings, railings and other outside iron and metal work, stoops and

approaches. and all other fixtures and appliances belonging or appertaining to the building situate

on sols Cliff Road, Bar Herbor Maine, and known as "Oldfarm

Cottage, formerly known as "Farmer's cottage. If

400. On frame stable and laundry building, adjacent thereto.

1,000. On Household Furniture, useful and ornamental, Wearing Apparel. Beds and Bedding. Jewelry in use, and

Watches, Musical Instruments, Sewing Machines, Plate and Plated Ware, Printed Books, Printed Music, Pictures

Paintings and Engravings including Frames. Sculpture, Statuary, Curiosities, Ornaments and Works of Art. and Objects

of Virtu at not exceeding cost, Fuel, Family Stores and Supplies, Crockery. Glass and China Ware, Bicycles, Type-

writers, Telescopes. Rugs, Carpets, Wines and Liquors, Cameras, Trunks and Traveling Equipments, and other use-

ful and ornamental things, the property of the assured or any member of the assured's household. all contained

in the above described dwelling, known as "Oldfarm Octtage. "

$1,000.

On stable contents, exclusive of automobiles, consisting principally

of horses, carriages, hay, grain, feed, harness, tools, and other

stable utensils, all while contained in "Oldfarm" stable.

In case of 1038 no horse to be valued over $300.

600.

on frame Laundry Building and additions, belonging to "Oldferm,"

and adjacent thereto.

500.

on Wood Shed and TOOL Room, belonging to "Oldfarm," and adjacent

thereto.

1,500.

On Gardener's Cottage and Additions, situate on the above

described estate.

500.

On Gardener's stable and additions, situate adjacent to

Gardener's cottage.

200.

On contents of Gardener's stable, exclusive of automobiles,

consisting principally of horses, carriages, hay, grain, feed,

harness, tools and other stable utensils.

In case of loss no horse to be valued over $200.

600.

On frase cottage and Additions, situate on his estate at the

Maine.

corner Of Main street and his Main Avenue, socalled, Bar Harbor,

1,000.

Bar Harbor, Maine.

On frame cottage and Additions, situate near Robin Flood Park,

200.

On frame Shed Building and TOOL ROOM, at the Quarry, Bar Harbor

Maine.

300.

On Contents of Shed Building and Tool ROO consisting principality

of Tonio mains, and Ropes.

100.

on Blacks 1th other cituate adjecent to above shed

Building.

100.

On Tools and Fixtures, all while contained in the above described

Blacksmith Shop.

1,000.

on "John Rich Cottage," and additions, situate adjacent to

"Oldfare. If

500.

On two sheds attached, altuate adjacent to new Avenue, SC called,

on the above described estate.

1,000.

on Contents of the above described sheds, consisting principally

of Carts, Tools, Hay, Rollers, and Phosphate.

$55,000.

It is understood that this Company covers under this policy

One-Fifth OF each of the above named FUMS amounting in the

aggregate to $11,000.

Other Insurance

Permission to have other insurance without notice until requested.

Permission is given to keep not exceeding one quart of benzine or naptha on the premises at any

one time, for domestic purposes only.

Repaire Clause

Privilege is granted to make ordinary alterations and repairs. it being expressly agreed and made a condition

of this policy that extraordinary alterations, additions and repairs shall not be made in or upon the premises

insured, or containing the property insured. and that (any custom of trade or business to the contrary notwith-

standing) no paint or similar substance shall be removed by burning in or about said premises without the consent

of this Company endorsed on this policy.

Unoccupancy

This policy will not be vitiated by any vacancy or unoccupancy of the insured premises.

Electricity

Permission is given for the use of Electricity for light, heat and power in the premises described by this policy.

Lightning Clause

This Policy also covers direct loss or damage to the property insured by lightning (meaning thereby the com-

monly accepted use of the term "lightning," and in no case to include loss or damage by cyclone. tornado or wind

storm.) whether fire ensues or not it being made a condition of this contract that any loss or damage to dynamos,

exciters, lamps, switches, motors, or other electrical appliances or devices, such as may be caused by lightning

or other electrical currents, artificial or natural, is expressly excluded, and that this Company is liable only for

such loss or damage to them as may occur in consequence of fire originating outside of the appliance or device

itself. It is also a condition of this contract that if there is any other insurance upon the property damaged this

Company shall be liable only for such proportion of any direct loss or damage by lightning (except as above

stated) as the amount hereby insured bears to the whole amount insured thereon, whether such other insurance

contains a similar clause or not.

Attached to Policy No.

of the

Ins. Co. of

Agents.

FRED C. LYNAM & CO

BAR HARBOR

MAINE

Feb

Expires hov. 1912

GEORGE B. DORR.

stone and frame

$30,000. On the

Dwelling House and additions, including foundations, towers, extensions porches

and

piazzas, plain, plate and ornamental glass, fresco, gilding, decorations and other ornamental and decorative works,

cabinet work, stationary mirrors, furnaces, plumbing, ventilating, heating, pumping. elevating and lighting and electrical

apparatus and fixtures, yard fixtures and fences, awnings. railings and other outside iron and metal work, stoops and

approaches. and all other fixtures and appliances belonging or appertaining to the building situate

on his estate, Bar Harbor, Maine, and known as "Oldfarm.

5,000. on frame stable and additions, belonging to "Oldfarm," and

adjacent thereto.

6,000. On Household Furniture, useful and ornamental, Wearing Apparel, Beds and Bedding, Jewelry in use, and

Watches, Musical Instruments. Sewing Machines. Plate and Plated Ware, Printed Books, Printed Music, Pictures.

Paintings and Engravings including Frames. Sculpture. Statuary, Curiosities, Ornaments and Works of Art. and Objects

of Virtu at not exceeding cost, Fuel, Family Stores and Supplies, Crockery, Glass and China Ware, Bicycles, Type-

writers, Telescopes, Rugs, Carpets, Wines and Liquors, Cameras, Trunks and Traveling Equipments, and other use-

ful and ornamental things, the property of the assured or any member of the assured's household, all contained

in the above described dwelling.