Page 1

Page 2

Page 3

Page 4

Page 5

Page 6

Page 7

Page 8

Page 9

Page 10

Page 11

Page 12

Page 13

Page 14

Page 15

Search

results in pages

Metadata

Harbor Club

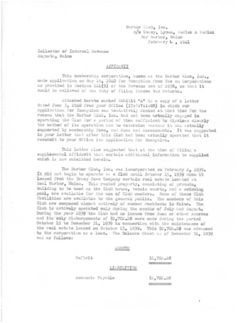

Harbor Club, Inc.

c/o Dansy, Lynam, Rodick & Rodick

Bar Harbor, Maine

February 6 , 1941

Collector of Internal Revenue

Augusta, Maine

AFFIDAVIT

This membership corporation, known LE the Harbor Club, Inc.,

made application on May 16, 1940 for Exemption from Tax on Corporations

as provided in Section 101(9) of the Revenue Act of 1938, so that it

would be relieved of the duty of filing income tax returns.

Attached hereto marked Exhibit "A" is a copy of a letter

dated June 3, 1940 from your Office (IT:P:T:1:HM) in which our

Application for Exemption was tentatively denied at that time for the

reason that the Harbor Club, Inc. had not been actually engaged in

operating the Club for & period of time sufficient to disclose clearly

the method of its operation and to determine whether it sea actually

supported by membership fees, and dues and assessments. It was suggested

in your letter that after this Club had been actually operated that it

resubait to your Office its Application for Exemption.

This letter also suggested that at the timo of filing a

supplemental Affidavit that certain additional information be supplied

which is now submitted herein.

The Harbor Club, Inc. was incorporated on February 2, 1939.

It did not begin to operate as a Club until October 15, 1939 when it

leased from the Bracy Cove Company certain real estate located at

Seal Harbor, Maine. This rented property, consisting of grounds,

building to be used as the Club house, tennis courts, and a swiaming

pool, are available for the use of Club members. None of these Club

facilities are available to the general public. The members of this

Club are composed almost entirely of summer residents in Maine. The

Club is actively operated only during the months of July and August.

During the year 1939 the Club had no income from dues or other sourcea

and its only disbursements of $2,702.28 were made during the period

October 15 to December 31, 1939 in connection with the maintenance of

the real estate lessed on October 15, 1939. This $2,702.28 was advanced

to the corporation as a loan. The Balance Sheet as of December 31, 1939

was as follows:

ASSETS

Deficit

$2,702.28

LIABILITIES

Accounts Payable

$2,702.28

2 -

During the year ended December 31, 1940 the Club has actually

been operated by Club dues, etc. which have been collected. Attached

hereto marked Exhibit "B" is a statement of income and expense for the

year ended December 31, 1940 which indicates a net loss for the year 1940

of $4,223.19. This income and expense statement indicates the collection

of membership dues, the payment of Federal Tax on Dues and Admissions,

etc. The Federal Tax on Admissions was collected on guest charges for

use of swimming pool.

The Balance Sheet as of December 31, 1940 is as follows:

ASSETS

Cash

$ 3,177.63

Deficit

6,925.47

$10,103.10

LIABILITIES

Accounts Payable

$10,103.10

The statement of income and expense discloses all sources

from which our income has been derived since incorporation as well as

the disposition of such income. This statement also discloses the

amounts received from members and their guests and amounts derived from

all other sources.

None of the income of this Corporation inures to the benefit

of any private shareholder or individual.

In our Affidavit dated May 16, 1940 we submitted the following

information which is incorporated herein by reference only:

(1) Certificate of Organisation under Chapter

Seventy of the Revised Statutes, and Amend-

ments thereto.

(2) Articles of Association.

(3) By-Lawa of Corporation.

- 3 -

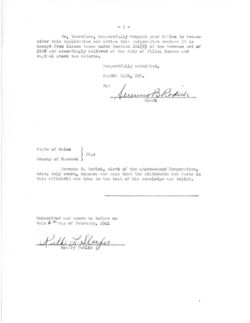

lie, therefore, respectfully request your Office to recon-

sider this Application and advise this Corporation whether 1t is

exempt from income taxes under Section 101 (9) of the Revenue Act of

1938 and accordingly relieved of the duty of filing income and

capital stock tax returns.

Respectfully submitted,

HARBOR CLUB, INC.

By:

Clerk

State of Maine

)

) SS.:

County of Hancock )

Serenus B. Rodick, clerk of the above-named Corporation,

being duly sworn, deposes and says that the statements and facts in

this affidavit are true to the best of his knowledge and belief.

Subscribed and aworn to before me

this 6th day of February, 1941

Ruth L Sleefer

Notary Public

$ XIIBII-"A*

Office of

TREASURY DEPARTMENT

COMMISSIONER OF INTERNAL REVENUE

WASHINGTON

Address reply to

JUN 3 1940

Commissioner of Internal Revenue

and refer to

ITsPaTel

FM

Harbor Club, Incorporated,

c/o Dosay, Lynam, Rodick and Rodick,

Bar Harbor, Maine.

Sirss

Reference is made to the evidence submitted by you in support of

your claim for exemption from Federal incono taxtion.

The evidence discloses that you were incorporated under the lars of

the State of Mine in January, 1939, to operate a clubhouse; to conduct

dancos, socials and musicals; to serve monls) to mintain a avising pool,

tennis courts, reading room and social and educational center for games

and anasements; and to mintain bosts and docks.

It is stated that you did not begin operation until October 15, 1939,

when you loused certain property at Seal Harbor, Haine, to be used sa a

club with clubhouse, tennis courts, swimming pool, etc., for the use of

club members; that none of these facilities will be available to the

general public; that your members will be composed almost entirely of

summer residents in Haine; that your club will be actively operated only

during the months of July and August; that during the year 1939 you had

no incons from any source, your only disbursements having boon the sum of

$2,699.15 for mintonance of your lessed property, which amount use advanced

as a loong and that no club dues will be collected until June or July of

this year.

Rulings of the Bureau with respect to the status of organizations for

Federal income tax purposes, are based largely upon their actual activities

over a period of time sufficient to disclose clearly their method of

operation. Insseuch as practically none of your activities at the present

time has consisted of carrying out the actual purposes for which you were

formed and as you have received no income other then a loan, it appears

that you are unable to furnish the evidence sufficient to deforming chether

you are a club organized and operated exclusively for pleasure, recreation

and other non-profitable purposes which La supported by membership fees,

dues and assessments, as required by Bureau regulations.

If you desire to resubmit your application for exemption after you

have actually been engaged in operating your club for a period of time

sufficient to disclose clearly your method of operation and to determine

whether you are actually supported by membership fees, dues and assessments,

careful consideration will be given to the case.

st that time you should submit an affidavit sworn to by ono of your

principal officers setting forth the following informations

1. Explanation in detail of your setual activities since your in-

corporation, that is, the panner in which you are carrying out the purposes

for which you were formed. (A statement of your purposes OF to the effect

that your activities are in accordance with such pruposos, cannot be

accepted in lieu of detailed information as to all activities in which you

are actually engaged.)

2. All sources from which your income has been derived since your in-

corporation.

3. Disposition made of your income.

40 Mother your facilities have at any tine born available for the

use of the general public.

5. Accounts derived from members and their guests since your incorpo-

ration and amounts derived from all other sources, stating the sources

from which received.

6. Whether any of your incone inures to the benefit of any private

shareholder or individual.

7. All other facts relating to your activities which may effect your

status.

In addition to the affidavit, there should be submitted a financial

statement for the complete period since your incorporation aboving your

assets and liabilities and a classified list of your receipts and dis-

bursements,

Respectfully,

Timpthy C. Mooney,

Deputy Commissioner,

By L. K. Sundorlin.

F.

Chief of Section.

6

HARBOR CLUB, INC.

STATEMENT OF INCOME AND EXPENSE

FOR THE YEAR ENDING DECEMBER 31ST, 1940

INCOME

Membership Dues

$10,300.00

Guest Charges

528.00

Taxes:

Federal Tax on Dues

1,030.00

Federal Tax on Admissions

52.80

Tea Income

567.75

Iced Drink Income

78.85

Miscellaneous Income

225.62

Tennis Equipment and Lessons

1,786.00

Swämming Lessons

297.00

Total Income -

$14,866.02

EXPENSES

Repairs and Maintenance

$ 2,107.01

Salaries and Wages

9,408.61

Light, Heat and later

895.70

Grounds

282.43

Insurance Expense

337.50

Miscellaneous Expense

1,017.27

Taxes:

Federal Insurance Contribution -

Employer's Tax

153.62

Real Estate Taxes (Paid as Lessee)

1,011.84

Federal Tax on Admissions

52.80

Federal Tax on Dues

1,121.45

Club Kitchen

379.68

Housekeeping Apartment

147.56

Telephone and Telegraph

91.24

Tennis Lessons and Equipment

1,785.50

Swimming Lessons

297.00

Total Expenses -

19,089.21

NET LOSS FOR THE YEAR 1940 $

$ 4,223.19

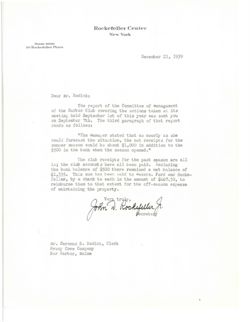

Rockefeller Center

New York

Room 5600

30 Rockefeller Plaza

December 26, 1939

Dear Mr. Rodick:

From the enclosed letter of December

21st regarding the financial statement of the Harbor

Club, you will note that the bank balance in the old

club has been withdrawn. Either in the Harbor Club,

Inc. meeting or the meeting of the Bracy Cove Company

last summer some action was taken with reference to

establishing a bank balance of $500 to take the place

of the $500 formerly kept by the old Harbor Club. What

was this action and has such a balance been set up?

If not, would it be in order for me to send to the bank

where Miss Greenwood does her banking a check for $500

to be deposited to the credit of the Harbor Club, Inc?

And, if so, should that check be put on a memorandum of

monies that I pay out in the off-season period for the

Harbor Club, an adjustment of which with Mr. Ford at the

end of the year is always made?

Please advise me what to do in this situa-

tion.

Very truly,

John D. Cockyfilling

Mr. Serenus B. Rodick

Bar Harbor

Maine

Rockefeller Center

New York

Room 5600

30 Rockefeller Plaza

December 21, 1939

Dear Mr. Rodick:

The report of the Committee of Management

of the Harbor Club covering the actions taken at its

meeting held September 1st of this year was sent you

on September 7th. The third paragraph of that report

reads as follows:

"The Manager stated that as nearly as she

could forecast the situation, the net receipts for the

summer season would be about $1,000 in addition to the

$500 in the bank when the season opened."

The club receipts for the past season are all

in; the club accounts have all been paid. Including

the bank balance of $500 there remained a net balance of

$1,335. This sum has been paid to Messrs. Ford and Rocke-

feller, by a check to each in the amount of $667.50, to

reimburse them to that extent for the off-season expense

of maintaining the property.

Very truly,

John W. Secretary

Mr. Serenus B. Rodick, Clerk

Bracy Cove Company

Bar Harbor, Maine

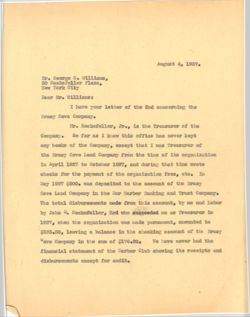

August so 1937.

Mr. George C. Williams,

30 Rockefeller Plaza,

New York City

Dear Mr. Williams:

I have your letter of the 2nd concerning the

Bracy Cove Company.

Mr. Rockefeller, Jre, is the Treasuror of the

Company.

So far as I know this office has never kept

any books of the Company, except that I was Treasurer of

the Bracy Cove Land Company from the time of its organization

in April 1927 to October 1927, and during that time wrote

checks for the payment of the organization fees, etc. In

May 1927 $500. was deposited to the account of the Bracy

Cove Land Company in the Bar Harbor Banking and Trust Company.

The total disbursements made from this account, by me and later

by John D. Rockofeller, 3rd who succeeded me as Treasurer in

1927, when the organization was made permanent, amounted to

$323.80, leaving a balance in the checking account of the Bracy

ove Company in the sum of $176.20.

We have never had the

financial statement of the Harbor Club showing its receipts and

disbursements except for audit.

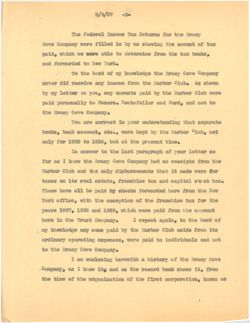

8/4/37

-2-

The Federal Income Tax Returns for the Bracy

Cove Company were filled in by us showing the amount of tax

paid, which we were able to determine from the tax books,

and forwarded to New York.

To the best of my knowledge the Bracy Cove Company

never did receive any income from the Harbor Club. As shown

by my letter to you, any amounts paid by the Harbor Club were

paid personally to Messrs. Rockefeller and Ford, and not to

the Bracy Cove Company.

You are correct in your understanding that separate

books, bank account, etc., wore kept by the Harbor Club, not

only for 1928 to 1936, but at the present time.

In answer to the last paragraph of your letter so

far as I know the Bracy Cove Company had no receipts from the

Harbor Club and the only disbursements that it made were for

taxes on its real estate, franchise tax and capital sto ck tax.

These have all be paid by checks forwarded here from the New

York office, with the exception of the franchise tax for the

years 1927, 1928 and 1929, which were paid from the account

here in the Trust Company.

I repeat again, to the best of

my knowledge any sums paid by the Harbor Club aside from its

ordinary operating expenses, were paid to individuals and not

to the Bracy Cove Company.

I am enclosing herewith a history of the Bracy Cove

Company, as I know ity and as the record book shows it, from

the time of the organization of the first corporation, known as

8/4/37

-2-

G.C.W.

the Bracy Cove Land Company, to the present time.

This

may be of some help to you in deciding the relationship

between the Bracy Cove Company and the Harbor Club.

Yours very truly,

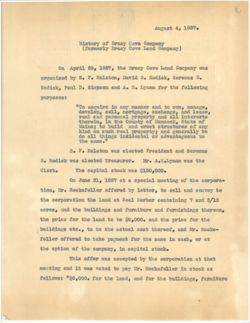

August 4, 1937.

History of Bracy Cove Company

(formerly Bracy Cove Land Company)

On April 25, 1927, the Bracy Cove Land Company was

organized by S. F. Ralston, David 0. Rodick, Serenus B.

Rodick, Paul D. Simpson and A. H. Lynam for the following

purposes:

"To acquire in any manner and to own, manage,

develop, sell, mortgage, exchange, and lease,

real and personal property and all interests

therein, in the County of Hancock, State of

Maine; to build and erect structures of any

kind on such real property; and generally to

do all things indidental or advantageous to

the same."

S. F. Ralston was elected President and Serenus

B. Rodick was elected Treasurer. Mr. A.H.Lynam was the

Clerk.

The capital stock was $150,000.

On June 21, 1927 at a special meeting of the corpora-

tion, Mr. Rockefeller offered by letter, to sell and convey to

the corporation the land at Seal Harbor containing 7 and 3/10

acres, and the buildings and furniture and furnishings thereon,

the price for the land to be $8,000. and the price for the

buildings etc., to be the actual cost thereof, and Mr. Rocke-

feller offered to take payment for the same in cash, or at

the option of the company, in capital stock.

This offer was accepted by the corporation at that

meeting and it was voted to pay Mr. Rockefeller in stock as

follows: "$8,000. for the land, and for the buildings, furniture

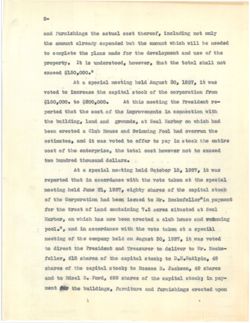

2-

and furnishings the actual cost thereof, including not only

the amount already expended but the amount which will be needed

to complete the plans made for the development and use of the

property. It is understood, however, that the total shall not

exceed $150,000."

At a special meeting held August 30, 1927, it was

voted to increase the capital stock of the corporation from

$150,000. to $200,000.

At this meeting the President re-

ported that the cost of the improvements in connection with

the building, land and grounds, at Seal Harbor on which had

been erected a Club House and Swinning Pool had overrun the

estimates, and it was voted to offer to pay in stock the entire

cost of the enterprise, the total cost however not to exceed

two hundred thousand dollars.

At a special meeting held October 18, 1927, it was

reported that in accordance with the vote taken at the special

meeting held June 21, 1927, eighty shares of the capital stock

of the Corporation had been issued to Mr. Rockefeller"in payment

for the tract of land containing 7.3 acres situated at Seal

Harbor, on which has now been erected a club house and swimming

pool.", and in accordance with the vote taken at a special

meeting of the company held on August 30, 1927, it was voted

to direct the President and Treasurer to deliver to Mr. Rocke-

feller, 618 shares of the capital stock; to D.H.McAlpin, 49

shares of the capital stock; to Roscoe B. Jackson, 49 shares

and to Edsel B. Ford, 699 shares of the capital stock; in pay-

ment 06r the buildings, furniture and furnishings erected upon

3-

the property above described, "said shares representing the

amount each of the parties has invested in said buildings,

furniture and furnishings."

At this meeting all the original organizers trans-

ferred the stock they held to Messrs. Rockefeller, Ford, McAApin,

and Jackson and resigned their positions as President, Treasurer,

and Directors.

Messrs. Rockefeller, Ford, McAlpin and Jackson were

elected Directors in the place of Messrs. Rodick, Lynam,

Ralston and Rodick, and Mr. Ford was elected President, Mr.

Rockefeller, 3rd., was elected Treasurer and Mr. Lynam continued

as Clerk.

At the annual meeting of the Bracy Cove Land Company

held August 7, 1928, the president reported the Bracy Cove

Company "was in the process of incorporation with broader

powers than those of this corporation, whereupon it was voted

to sell and convey the real and personal property of the corpora-

tion to the Bracy Cove Company for the sum of $150,000. being

the amount paid therefor by this corporation."

It was also voted at this meeting "that after the

payment of all debts and the distribution of all assets among

the stockholders this corporation be dissolved and that the

President be authorized to take all measures necessary under

the Statute to dissolve the corporation without the appointment

of trustees or receivers."

The Bracy Cove Land Company was dissolved and the

Bracy Cove Company was organized July 27, 1928 for the

following purposes:

"To acquire in any manner and to own,

manage, develop, sell, mortgage, exchange,

and lease, real and personal property and

all interest therein, in the County of Han-

cock, State of Maine; to build, erect, main-

tain and operate club houses, swimming pools,

wharfs, bath houses, floats, boat houses,

tennis courts and structures of any kind

on such real property; to promote and culti-

vate any or all kinds of sports and games;

and to furnish amusements and entertainments;

and generally to do all things incidental or

advantageous to the same."

The organizers were John D. Rockefeller, Jros Roscoe

B. Jackson, Do H. McAlpin, John D. Rockefeller, III, and Edsel

B. Ford, and the capital stock was $150,000.

D. H. McAlpin, Roscoe B. Jackson, Edsel B. Ford

and John Do Rockefeller, Jro, were elected Directors, and

Mr. Ford was elected President, John D. Rockefeller, Jrog

was elected Treasurer and the Clerk was A. H. Lynam.

The stock issued in the Bracy Cove Company was

50 shares to D. H. McAlpin; 50 shares to Roscoe B. Jackson;

700 shares to Edsel B. Ford; 699 shares to Mr. Rockefeller,

Trey and 1 share to Mr. Rockefeller, 3rd.

At a meeting of the directors held August 24th,

1928 Messrs. Rockefeller, Ford, Jackson and McAlpin were

appointed as a "Committee of Management of the Harbor Club".