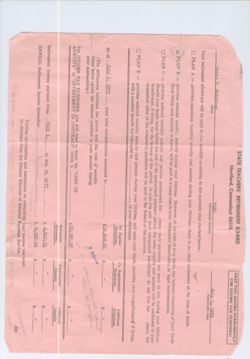

McSorely - Doris Preble McSorely State Teachers' Requirement Board.

U-4/67

STATE TEACHERS' RETIREMENT BOARD

KEEP THIS RECORD PERMANENTLY

Hartford, Connecticut 06115

FOR INCOME TAX PURPOSES!

Doris P. McSorley

9320

name

July 1, 1973

retirement number

retirement date

Your retirement allowance will be paid to you monthly according to the payment plan checked below:

PLAN A - provides maximum monthly annuity and pension during your lifetime; there is no other settlement at the time of death.

PLAN B - provides reduced monthly annuity during your lifetime. However, at the time of your death, any balance remaining

of

from which such annuity is drawn, will be paid in a lump sum to your designated beneficiary or legal representative.

your

funds

PLAN C - provides reduced monthly annuity and pension guaranteed for years ; such payments are made to you during your lifetime.

Should your death occur before the end of the guaranteed payment period, the same annuity and pension will be continued to your

beneficiary, if living, for the balance of the period. In case you and your recognized beneficiary do not live for - years,

the

commuted value of the remaining payments will be paid to the Estate of the survivor.

PLAN

D - provides reduced monthly annuity and pension during your lifetime, and upon your death, provides your co-participant, if living,

with a monthly benefit for life equal to

of your allowance.

5% Regular

1% Supplemental

Additional

Deductions

Deductions

Deductions

As

of

July 1, 1973

,

your total accumulations amounted to

$16,608.65

-

$

-

(The difference between the above and the cost of annuity

Indext

out

of check

listed below equals the interest credited to your account during

your membership.)

Actually

taken for comption

ANIC.

For INCOME TAX PURPOSES, you will need to know the "COST OF

ANNUITY" or "INVESTMENT IN CONTRACT" which is

-

-

$ 10,320.27

$

$

Retirement

Supplemental

Additional

Allowance

Annuity

Annuity

Retirement Income payment from July 1,

-

-

to Dec. 31, 1973

$ 4,641.54

$

$

ANNUAL Retirement Income thereafter

My yearly encome

$ 9,283.08

-

$

$

-

773,54812

Further information and instruction on computing !your income tax must

be obtained from the District Director of Internal Revenue Service.

Figurent JMM on

With yearly

9283

the

10,32